Why Choosing a Fiduciary Advisor Matters.

When it comes to your money, loyalty shouldn’t be optional.

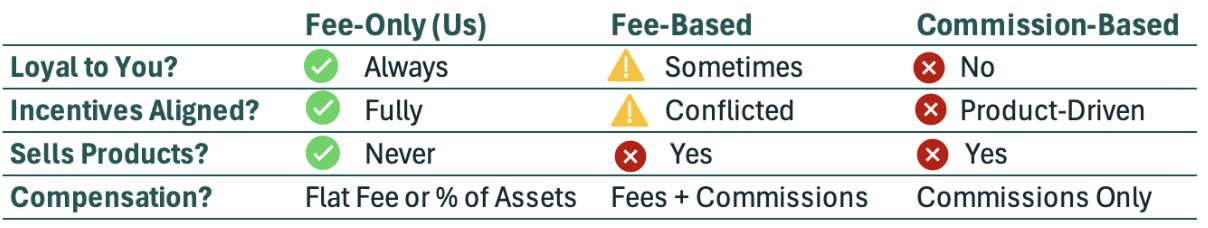

Here’s what it means to work with a Fee-Only, Fiduciary advisor — and why it should be the minimum standard.

Why Choosing a Fiduciary Advisor Matters.

When it comes to your money, loyalty shouldn’t be optional.

Here’s what it means to work with a Fee-Only, Fiduciary advisor — and why it should be the minimum standard.

A fiduciary advisor is legally and ethically obligated to act in your best interest — not just offer “suitable” advice.

Unlike brokers or product-driven advisors, fiduciaries don’t get paid to sell. They get paid to protect you.

We work for you — not a parent company, product line, or sales quota.

Our only incentive is helping you grow and protect your wealth.

No hidden fees, no surprise charges, no complex layers.

Our success is tied to your success — not a transaction.

Imagine two advisors give you the same portfolio. One earns a commission when you buy a certain product. The other earns nothing extra and is only paid by you. Who do you trust more?

Every advisor at Marbella Wealth commits in writing to:

Choosing a fiduciary means choosing advice with no hidden agenda. Let’s talk about what that looks like for you.